Paul Barron Toolkit MSI 2.0

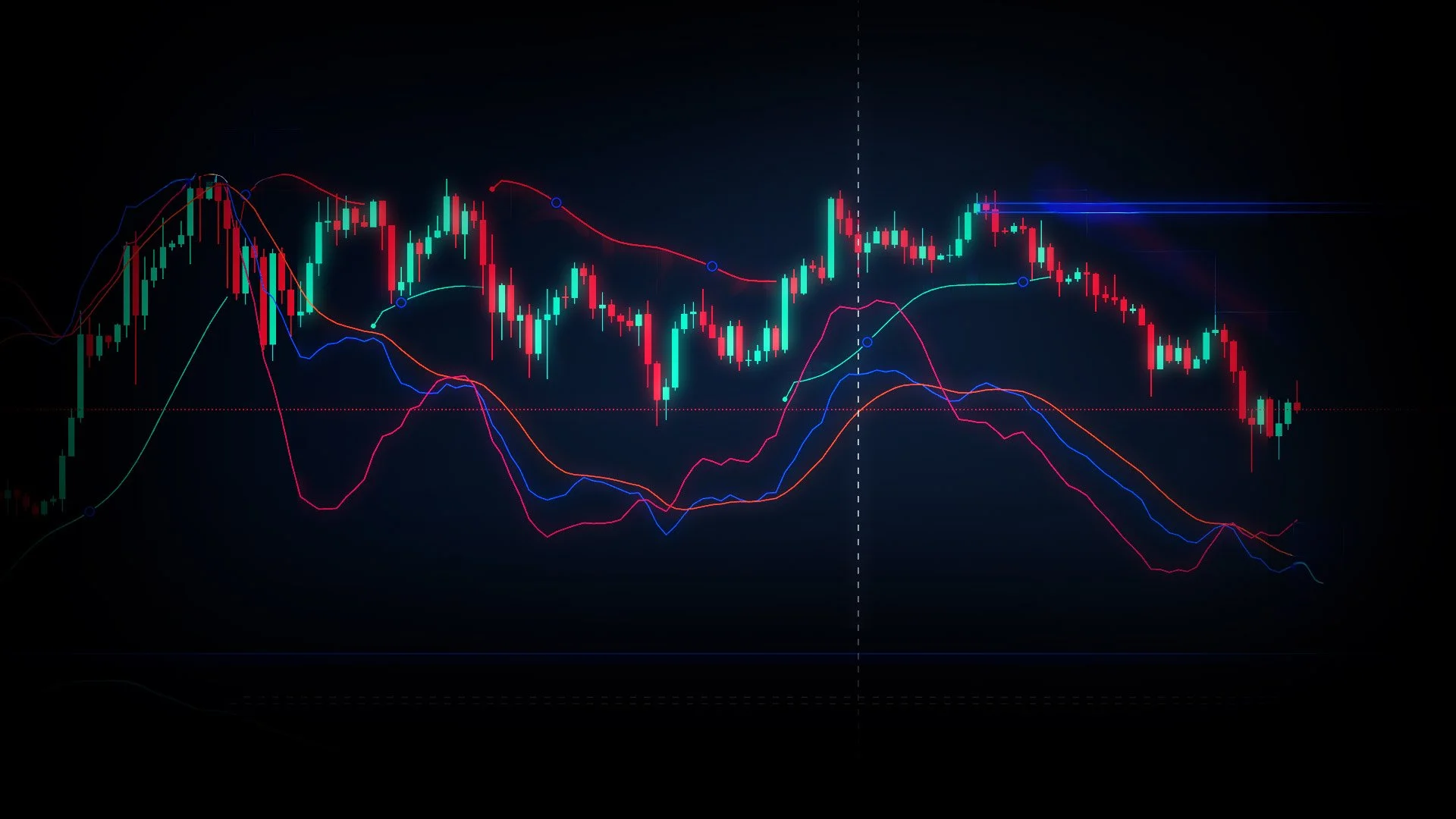

Real-time market sentiment intelligence that turns your TradingView into a profit-predicting powerhouse.

The Paul Barron Toolkit MSI 2.0 is a next-generation crypto analytics tool developed by the Paul Barron Network, designed to bring clarity, confidence, and deeper insights into the often unpredictable world of digital assets. By leveraging cutting-edge AI and social data analytics, MSI delivers a real-time view of crypto momentum, investor behavior, and market sentiment across the most relevant tokens and projects.

MSI is available exclusively through the Forge Membership, and subscribers can also use MSI live within TradingView charts as an integrated invite-only indicator.

What MSI Measures

MSI analyzes multiple key layers of the crypto ecosystem:

Overall Crypto Momentum Scoring: Captures social sentiment across four major platforms to quantify short-term and long-term investor momentum.

Trading Volume & Sentiment: Monitors flows of capital, identifying retail vs. institutional positioning across tokens.

Tokenomics & Project Analysis: Evaluates fundamentals like token supply, utility, staking, and developer commitment.

Key Updates in 2025

Momentum Scoring on Top 50 Tokens

MSI now delivers AI-driven momentum scoring for the top 50 projects by market relevance. It highlights both retail and institutional interest, presenting a balanced view of the true momentum in crypto.

MSI Bot Detection

Our advanced AI-powered Bot Detection System filters synthetic activity across social platforms. By identifying accounts with inauthentic engagement patterns, MSI isolates genuine investor sentiment and weeds out manipulative signals. This ensures our scoring reflects the real voice of the market, not bot-driven hype.

The Momentum Scoring feature is one of the most significant upgrades to the Market Sentiment Index, as it captures the deeper shifts in both investor psychology and project fundamentals in real-time. Unlike simple sentiment analysis, momentum goes beyond “positive vs. negative” chatter and evaluates the strength, duration, and direction of investor conviction around a token.

How Momentum Scoring Works

Top 50 Token Coverage

Momentum is tracked on the top 50 cryptocurrency projects by market size and relevance, ensuring users get insights on the most influential assets shaping market behavior.AI-Powered Social Sentiment Analysis

The system leverages machine learning to process millions of conversations across four major platforms, weighing retail chatter against higher-level discussions from analysts, institutions, and developers.Retail vs. Institutional Dissection

MSI classifies momentum into two distinct groups: retail investors, who often move markets in the short term, and institutional players, who typically drive long-term support and stability. This dual lens gives a more balanced market forecast.Scoring Framework

Momentum is quantified into a simple numerical score where surging enthusiasm, rising developer activity, and growing liquidity push scores upward, while waning interest, negative news, or flat trading volumes reduce momentum strength.

Join FORGE now to gain access to the Paul Barron Toolkit MSI 2.0